Unbeatable accounting

and banking services

Financial software and services for passioned entrepreneurs

Talenom One

Software, banking and accounting

for small organizations

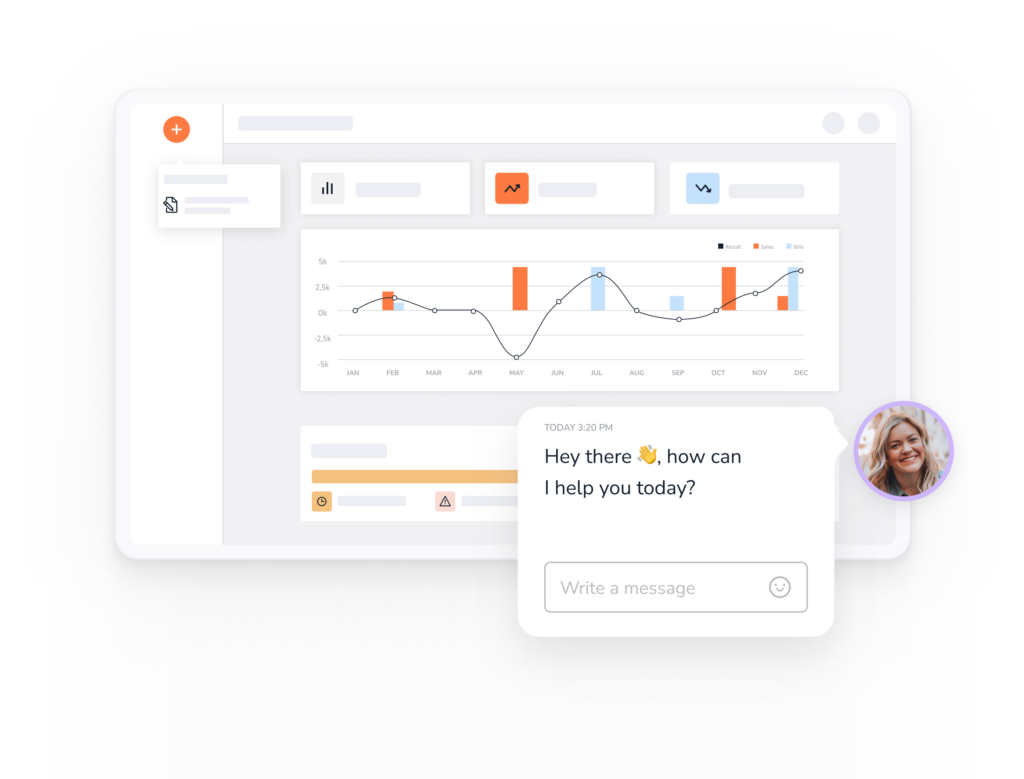

Talenom Pro

Comprehensive solution with

high quality advisory services